💸 Making Money vs. Keeping It: Why High Income Won't Buy Financial Freedom

It’s the quiet panic that nobody talks about.

You look at your invoices. You look at your salary. On paper, you are doing great. You are "successful." Maybe you are earning six figures, or your business just had its best quarter ever.

So why does your stomach churn when a surprise $500 bill shows up? Why do you feel broke despite the high income?

As Morgan Housel writes in his masterpiece The Psychology of Money:

Wealth is what you don't see. Wealth is the nice cars not purchased. The diamonds not bought. The watches not worn, the clothes not acquired.

If you have a high income but zero liquidity, you haven't achieved financial freedom; you just have expensive habits. You are confusing "Income" with "Wealth" (Net Worth). To fix this, you need to stop just "tracking spending" and start managing your Cash Flow.

The "Rat Race" Trap (Why Your Spending Tracker Isn't Helping)

Robert Kiyosaki, author of Rich Dad Poor Dad, coined the term "Rat Race," and in 2026, it applies to high-level freelancers and agency owners more than ever.

Most people try to solve this with a basic spending tracker or a spreadsheet. They look backward at what they spent yesterday. But looking in the rearview mirror won't stop you from crashing.

Income triggers spending. You get a big client? You lease a Tesla. You get a raise? You move to a bigger apartment. You run faster on the wheel, but your Net Worth stays flat. You are technically "rich" in revenue, but poor in reality.

To break this cycle, you need to stop obsessing over the "Income" column and start obsessing over the Timing of your money.

Profit is Theory. Cash Flow is Reality.

Sir Richard Branson has founded over 400 companies. Do you know what his #1 rule for survival is?

Never take your eyes off the cash flow because it's the lifeblood of business.

He doesn't say "profit." He says "cash flow". Why?

- Profit is accounting. It happens when you send the invoice.

- Cash Flow is oxygen. It happens when the money actually hits your bank account.

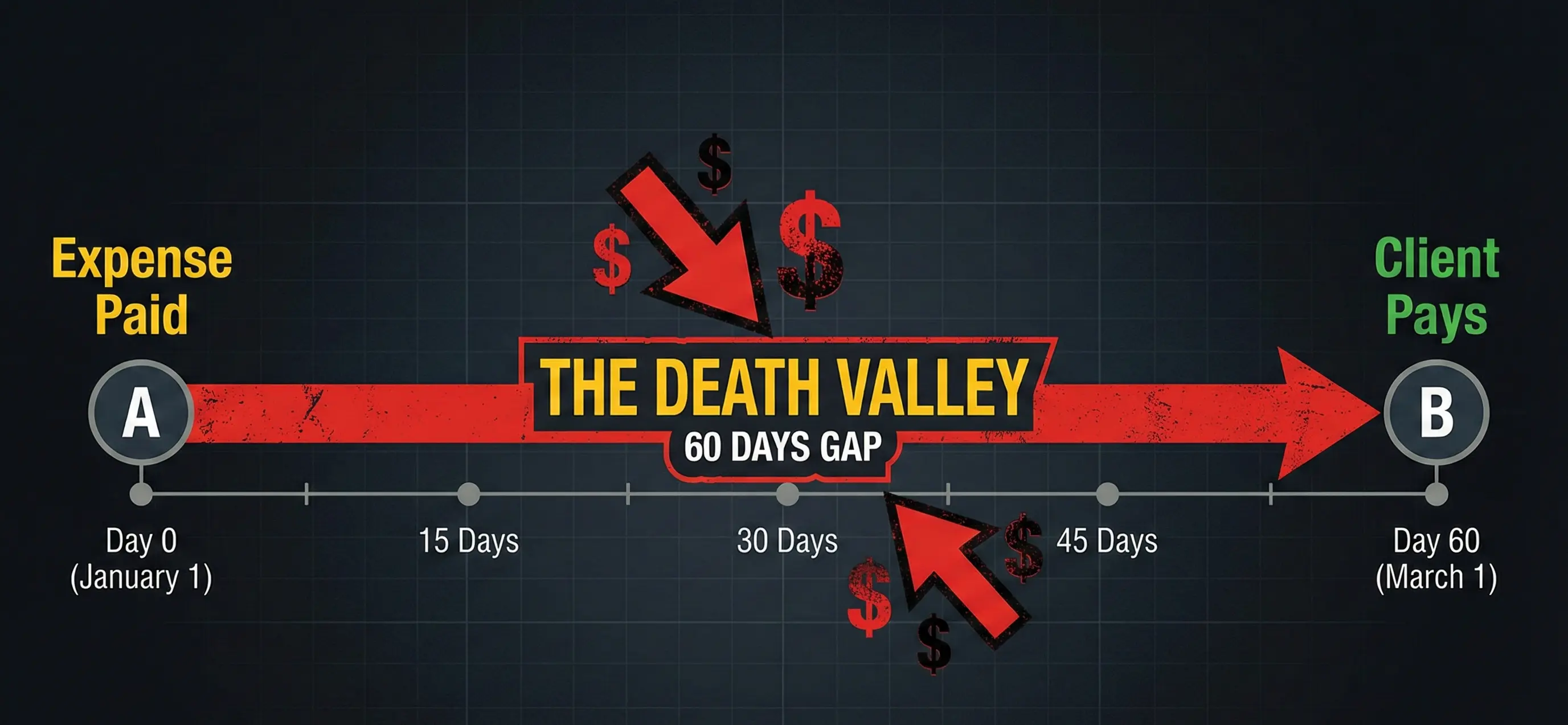

Here is the pain point: If you spend money on Day 1 (to deliver a project) but get paid on Day 60, you have a 60-day "Death Valley". You are profitable on paper, but you are bleeding out your lifeblood. No basic expense tracker warns you about this; only a proper cash flow projection can.

3 Habits That Are Killing Your Financial Life

If you want to stop the bleeding, look at your habits. As James Clear says in Atomic Habits: "You do not rise to the level of your goals. You fall to the level of your systems."

If your system is just checking your bank balance, your system is broken.

1. The "Mental Math" Mistake

- The Lie: You see $2,000 in the bank and think, "I have money."

- The Reality: You forgot the tax bill due next week.

- The Fix: Cash Projection. You need a money management app like FinFlow that predicts your balance before the bills hit, allowing you to see the future, not just the present.

2. The "Parkinson's Law" of Spending

- The Lie: "I'll save what's left over at the end of the month."

- The Reality: Expenses always rise to meet income. There is never anything left over to build your Net Worth.

- The Fix: Pay Yourself First. Automate your profit into a separate Workspace instantly.

3. Ignoring the "Leakage"

- The Lie: "It's just a $15 subscription, it doesn't matter."

- The Reality: A small leak will sink a great ship. Without a rigorous expense tracker app that categorizes these leaks, they compound and eat up your freedom.

How to Finally Sleep at Night

Understanding Cash Flow brings peace. When you organize your entire financial life, the anxiety disappears.

You stop guessing. You stop hoping the client pays on time. You start planning.

This is why I built FinFlow. I didn't need another generic budget app. I needed a robust tool that respected the principles of Branson, Housel, and Kiyosaki: Keep the cash moving, keep it visible, and keep it safe.

- Real-time Multi-currency: Because exchange rates eat your cash flow silently.

- Cash Projection: To see your future balance and avoid the "Death Valley".

- Net Worth Tracker: To ensure you are actually building wealth, not just churning cash.

Making money is a skill. Managing Cash Flow is a superpower. In 2026, make sure you have both.

🎯 Are you tired of the "High Income, Low Cash" cycle? Start tracking your Net Worth and Cash Flow today with FinFlow.